Cost Drivers Examples In Service Industry

A cost driver: • Is any factor whose change causes a change in the total cost of a related cost object. Hence a change in the level of cost driver will cause a change in the level of the total cost of a related cost object. Examples of cost driver used in the following business units: • Research & Development:- Number of research projects, technical complexities of the projects • Design of products, services & process:- number of products in design, number of parts per product, • Marketing:- number of advertisement run, number of sales personnel, sales revenue • Distribution:-number of items distributed, number of customers, weight of items distributed • Customer services:-numbers of service calls, hours spent in servicing of products.

Page/Link: Page URL: HTML link: The Free Library. Retrieved Mar 10 2019 from The current accounting literature is filled with activity based costing ABC~ articles about cost drivers in manufacturing settings but very few examples of cost driver applications in service firms or industries exist. A number of the applications of cost drivers in manufacturing plants, however, involve service functions rather than a manufactured product.

The current accounting literature is filled with activity based costing ABC~ articles about cost drivers in manufacturing settings but very few examples of cost. May 18, 2014 - Chart the critical path of the service; create process maps. Activities, Expenses, Drivers, Cost Objects, Activity Pools. Examples of these costs are the cost per hour of a surgeon's time and cost of diagnostic tests.

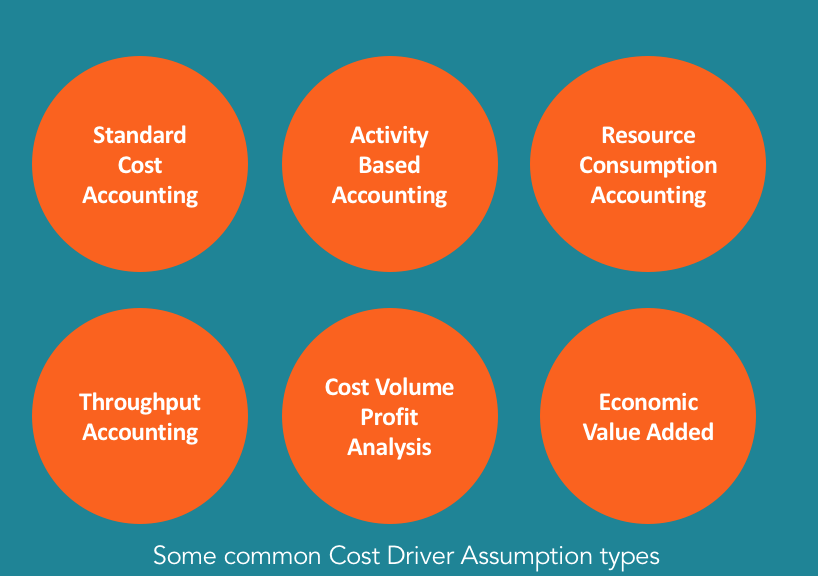

Since cost driver and ABC concepts improve the cost measurement and allocation information for service departments within manufacturing firms, service firms (such as accounting or law firms) could also use cost driver and ABC concepts. A change to cost driver techniques will provide better cost information for service firms as it has for manufacturing firms. Activity based costing will help accounting firms answer questions such as: What does it cost to prepare a tax return? What is the cost of doing an audit? How should the common costs be allocated to a particular engagement?

Can costs be measured better and used for pricing of services? Cost Allocations Cost allocations are arbitrary and cannot be proven correct (or incorrect) because they depend on subjective judgement and not on a verifiable cause/effect relationship. Even though arbitrary, allocations are done in practice because the advantages outweigh the disadvantages. The methodology for making cost allocations involves two separate issues: 1.

The pools or categories of indirect costs that should be identified, aggregated and allocated together. The basis over which the costs in any given pool should be allocated. It is the second issue that gives rise to the search for cost drivers or allocation bases.

A number of criteria are used by companies for evaluating cost allocation methods. Most authorities agree allocations should be made on the basis of the factors that caused the cost to be incurred. Elektronnij rozzhig pechki zaz. This criterion is most useful for variable costs like direct labor in an accounting or a law firm. It is less useful for fixed costs--like office rent or building depreciation--that represent a capacity decision by the firm to provide facilities for a particular level of service. Cost Drivers The most acceptable method of assigning costs to a product or service is to select drivers that approximate the underlying behavior of the costs to be allocated. This causal relationship is generally regarded as the best method for allocating indirect costs.